In today's fast-paced business environment, financial model templates have become essential tools for entrepreneurs, analysts, and corporate decision-makers alike. These templates streamline the process of financial forecasting, budgeting, and valuation, allowing users to focus on strategic decision-making rather than getting bogged down in complex calculations. Whether you are a startup founder seeking to secure funding or a seasoned executive looking to assess the financial viability of a new project, having a reliable financial model template at your disposal can significantly enhance your chances of success.

By providing a structured framework for organizing financial data, model templates not only save time but also improve accuracy and consistency in financial reporting. The right template can adapt to various industries and scenarios, making it a versatile asset for any business. In this guide, we will explore the different types of financial model templates available, their components, and how to effectively customize them to suit your unique financial needs. Embracing these tools will empower you to unlock your potential and drive informed financial decisions.

Types of Financial Model Templates

Financial model templates come in various forms, each serving distinct purposes tailored to specific business needs. One of the most common types is the budgeting model. This template focuses on outlining a company’s financial plan, detailing income and expenses over a given period. It allows businesses to forecast revenue, manage costs, and assess profitability, essential for ensuring that resources are allocated effectively.

Another popular financial model template is the discounted cash flow model. This template is crucial for valuing an investment or business by analyzing the present value of expected future cash flows. It incorporates assumptions about revenue growth, operating expenses, and the discount rate, enabling stakeholders to make informed investment decisions based on the anticipated return on investment.

Finally, there are scenario analysis templates, which help businesses assess the impact of various possible future events on their financial performance. These templates allow users to create multiple scenarios, such as best-case, worst-case, and most likely outcomes, facilitating strategic planning and risk management. By utilizing these templates, businesses can better prepare for uncertainties in the market and develop flexible strategies to navigate potential challenges.

Key Components of Effective Financial Models

Effective financial models are built upon a foundation of clear assumptions and inputs. These assumptions serve as the backbone of the model, impacting all projected outcomes. It's essential to use realistic data derived from historical performance or industry benchmarks to create a credible framework. By clearly outlining the assumptions, users can adjust variables and see how these changes impact the overall financial health of the business. This transparency not only enhances the model's reliability but also aids in communicating insights to stakeholders.

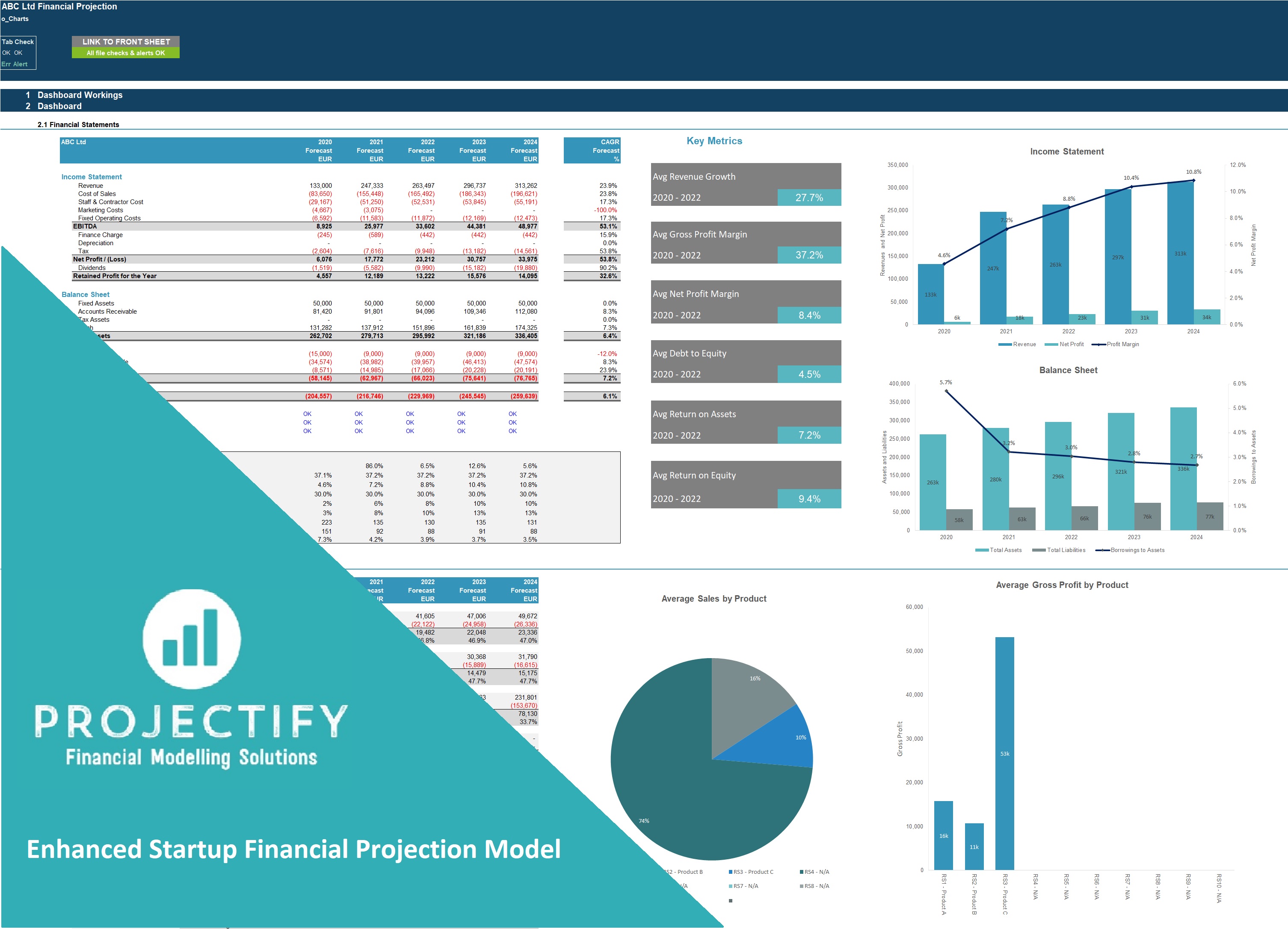

Another critical component is the integration of detailed financial statements. A well-structured model typically includes an income statement, balance sheet, and cash flow statement, which interlink to provide a comprehensive view of the business's financial performance. These statements should reflect multiple scenarios, including best-case and worst-case outcomes, to prepare for potential fluctuations in market conditions. By ensuring that these components are accurately represented and readily adjustable, users can derive valuable insights and make informed decisions.

Lastly, effective financial models prioritize user-friendliness and clarity. A model should be organized in a way that makes it easy for users to navigate and understand, regardless of their financial expertise. This can be achieved through the use of consistent formatting, labeled sections, and structured layouts that guide the user through the analysis. Additionally, incorporating visual aids like charts and graphs can significantly enhance comprehension, making it easier to convey complex financial information. Ultimately, a model that is both accessible and informative will lead to better decision-making and strategic planning.

How to Customize Financial Model Templates

Customizing financial model templates is essential to tailor them to specific needs and scenarios. Start by reviewing the default assumptions and inputs to ensure they align with your unique business model or project. This may involve adjusting revenue projections, cost structures, and other key performance indicators that directly impact financial outcomes. Pay close attention to the formulas used in the templates, as these calculations form the backbone of your model's reliability.

Next, incorporate relevant historical data if available, as this provides context and improves the accuracy of your forecasts. You should also think about scenario analysis, which allows you to visualize how changes in key assumptions will influence financial results. Including sensitivity analyses can further enhance your model by showcasing potential risks and rewards. Consider using graphs and charts within the template to present this information clearly and compellingly for stakeholders.

Finally, don’t forget to keep your models user-friendly. Ensure that any custom features or adjustments you make are thoroughly documented within the template. This not only facilitates easier interpretation for others but also helps you or your team members return to the model without confusion. A well-organized and customized financial model template can significantly enhance decision-making processes, making it a vital tool for achieving your financial goals.